Key Factors to Consider When Picking the Right Audit Technique

Picking the suitable accounting method is a vital choice that can substantially affect your monetary health and general business success. As you think about these elements, it's crucial to additionally show on the relevance of customer evaluations and the firm's reputation.

Know-how and Qualifications

In the realm of accountancy, competence and credentials offer as the keystone for reliable monetary administration. When choosing an accounting practice, it is crucial to think about the qualifications of the experts included.

Additionally, specialization within the accounting field can significantly impact the quality of solutions made. Some professionals concentrate on areas such as tax preparation, bookkeeping, or forensic bookkeeping, which can provide a more comprehensive understanding of certain customer demands. Furthermore, industry experience is essential; accountants with a tried and tested performance history in your particular sector will certainly be much more adept at browsing the one-of-a-kind economic difficulties you might deal with.

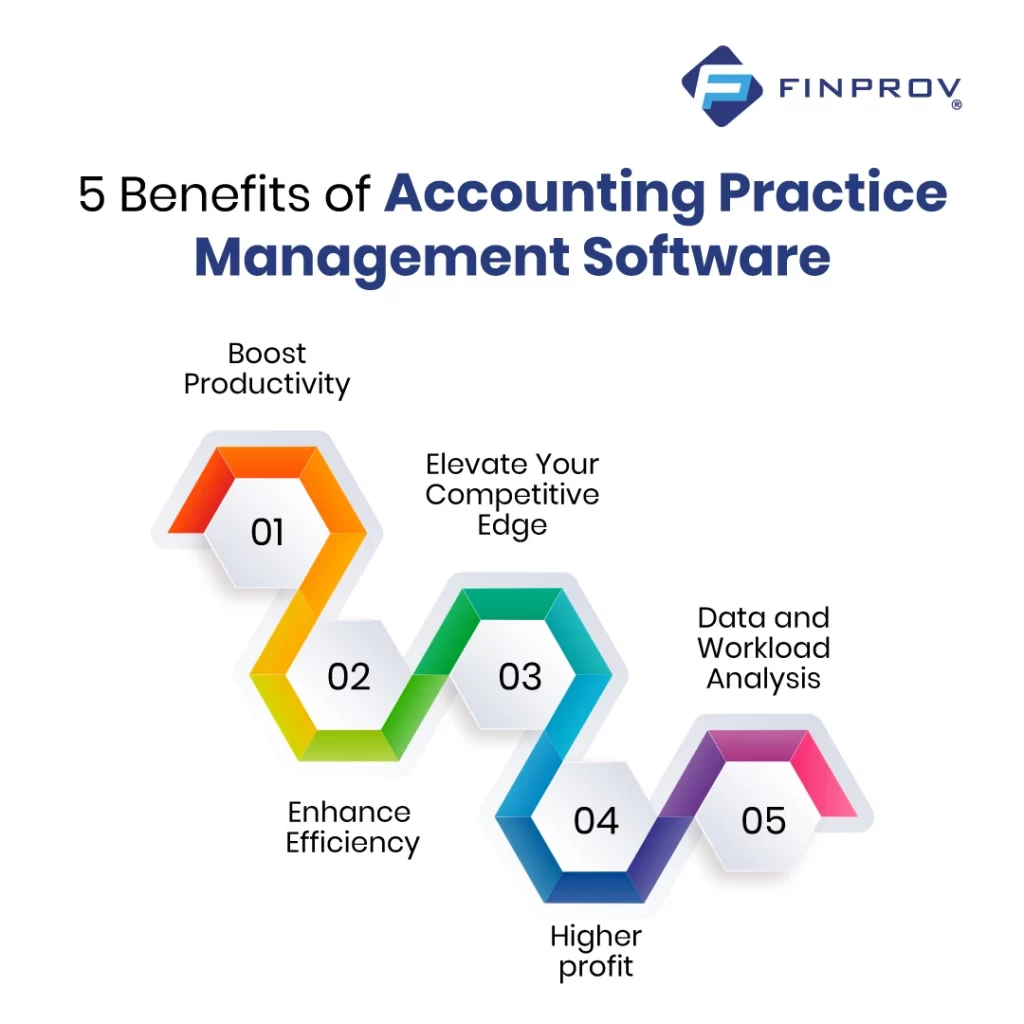

Lastly, modern technology efficiency plays an important duty in contemporary accountancy methods. With the enhancing dependence on bookkeeping software program and economic analytics, guaranteeing that the practice utilizes professionals that are adept with these devices can enhance precision and efficiency in monetary coverage. Succentrix can help you start an accounting practice. Choosing a firm with the appropriate expertise and certifications will inevitably result in appear financial decision-making

Range of Solutions

Businesses, particularly, must take into consideration firms that provide tailored services appropriate to their industry. For instance, a method experienced in taking care of the complexities of manufacturing or non-profit fields can provide insights and services that generic firms may neglect. Extra services such as payroll management, organization evaluation, and sequence planning can be very useful as firms expand and progress.

Additionally, ensure that the accounting technique remains updated with the most recent laws and technical improvements, as this can substantially enhance the quality of solution offered. Ultimately, a company that provides a vast array of solutions is much better positioned to work as a long-lasting partner, efficient in adjusting its offerings to suit your altering monetary landscape. This versatility can contribute considerably to your business's general success and financial wellness.

Communication and Access

Reliable interaction and accessibility are important aspects when choosing an audit practice, as they straight influence the high quality of the client-firm relationship. A company that focuses on clear and open communication cultivates trust and makes sure that clients feel valued and recognized. It is important to assess just how a practice interacts vital information, whether with normal updates, prompt reactions to questions, or the ability to discuss complicated economic concepts in layperson's terms.

Availability is just as essential; clients need to really feel certain that they can reach their accounting professionals when required. This consists of thinking about the company's operating hours, schedule for appointments, and responsiveness through various channels, such as phone, e-mail, or in-person conferences.

Moreover, modern technology plays an important role in improving communication and accessibility. A practice that leverages modern-day communication tools, such as safe customer websites or mobile applications, can assist in information sharing and make it much easier for customers to access their monetary data anytime, anywhere. Eventually, a firm that masters communication and ease of access will not only streamline the accounting process yet additionally construct a strong, long-lasting collaboration with its customers, guaranteeing their needs are satisfied successfully.

Cost Framework and Transparency

Comprehending the fee framework and making certain openness are essential aspects when evaluating an accounting technique. A clear and thorough charge framework allows customers to great post to read anticipate costs and spending plan appropriately, reducing the potential for misconceptions or unforeseen expenses. It is crucial to make inquiries whether the practice makes use of a set fee, per hour rate, or a mix of both, as this can dramatically affect total expenses.

In addition, transparency in payment methods is important (Succentrix can help you start an accounting practice). Customers must receive clear billings outlining solutions rendered, time spent, and any added fees. This level of information not only promotes trust however also makes it possible for clients to analyze the worth of the solutions provided

Finally, take into consideration whether the accountancy practice is eager to offer written arrangements that describe all solutions and connected costs. This can work as a guard against shocks and ensures both celebrations have a common understanding of expectations. By focusing on fee framework and openness, clients can make educated choices that align with their monetary purposes.

Client Evaluations and Reputation

Several customers locate learn this here now that the reputation of an audit technique plays an essential role in their decision-making procedure. A well-regarded company is typically identified with reliability, professionalism, and competence. Customers commonly seek evaluations and testimonies to determine the experiences of others, which can significantly affect their choice of bookkeeping service.

In addition, it is advisable to investigate the practice's record with respect to compliance and honest criteria. A company that has actually encountered corrective actions may present a danger to your monetary stability.

Conclusion

In conclusion, picking an appropriate audit method requires mindful evaluation of several vital aspects. Detailed research into customer testimonials and the company's total reputation offers important insights into dependability and professionalism and trust, making certain educated decision-making.